Financial freedom is the ability to make choices about how you want to live your life, free from the constraints of financial worries. Achieving this freedom requires careful planning and discipline, but it can ultimately lead to a more fulfilling and stress-free life.

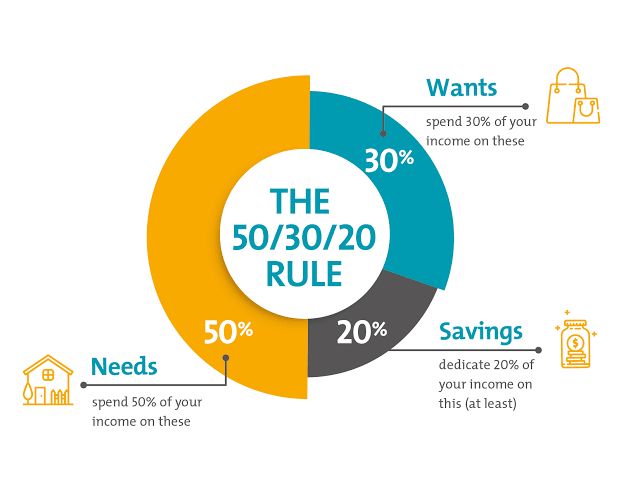

One way to work toward financial freedom is by wisely allocating your income into different categories of expenses. A common recommendation is to allocate 50% of your income to needs, 30% to wants, and 20% to savings. “Needs” include essential expenses such as rent, utilities, and groceries. “Wants” refer to non-essential expenses such as entertainment, parties, and hobbies. “Savings” are funds set aside for future expenses or emergencies. In essence, achieving financial freedom is possible with SMART goals and the 50/30/20 rule.

For salary earners, it’s crucial to plan ahead and manage your spending wisely, especially during the festive season, to ensure you have enough funds to cover your expenses until your next paycheck (probably ending of January, 2025). This may involve budgeting carefully and reducing discretionary spending. Never spend beyond your earnings. As much as possible, avoid unnecessary expenditures and unimportant journeys.

Building an emergency fund is also important to cover unexpected expenses and help prevent reliance on anticipated income. Most importantly, follow Warren Buffett’s advice: “Do not save what is left after spending, but spend what is left after saving.” Please exercise financial prudence (Proverbs 21:20).

In conclusion, achieving financial freedom requires planning and discipline, but it leads to a more fulfilling, stress-free life. By allocating your income wisely and planning ahead, you can reach your financial goals and live the life you desire.

You will NEVER be stranded financially, in Jesus’ Name.

DO ENJOY A SWEET SATURDAY

@ afo4Jesus